Fees and Brochure Download

Abbey Wood Grange Nursery and Pre-School, offering exceptional childcare within Kenley and the surrounding areas. Abbey Wood Grange is the largest independent Nursery in Kenley, South Croydon celebrating our 32 year anniversary in 2022.

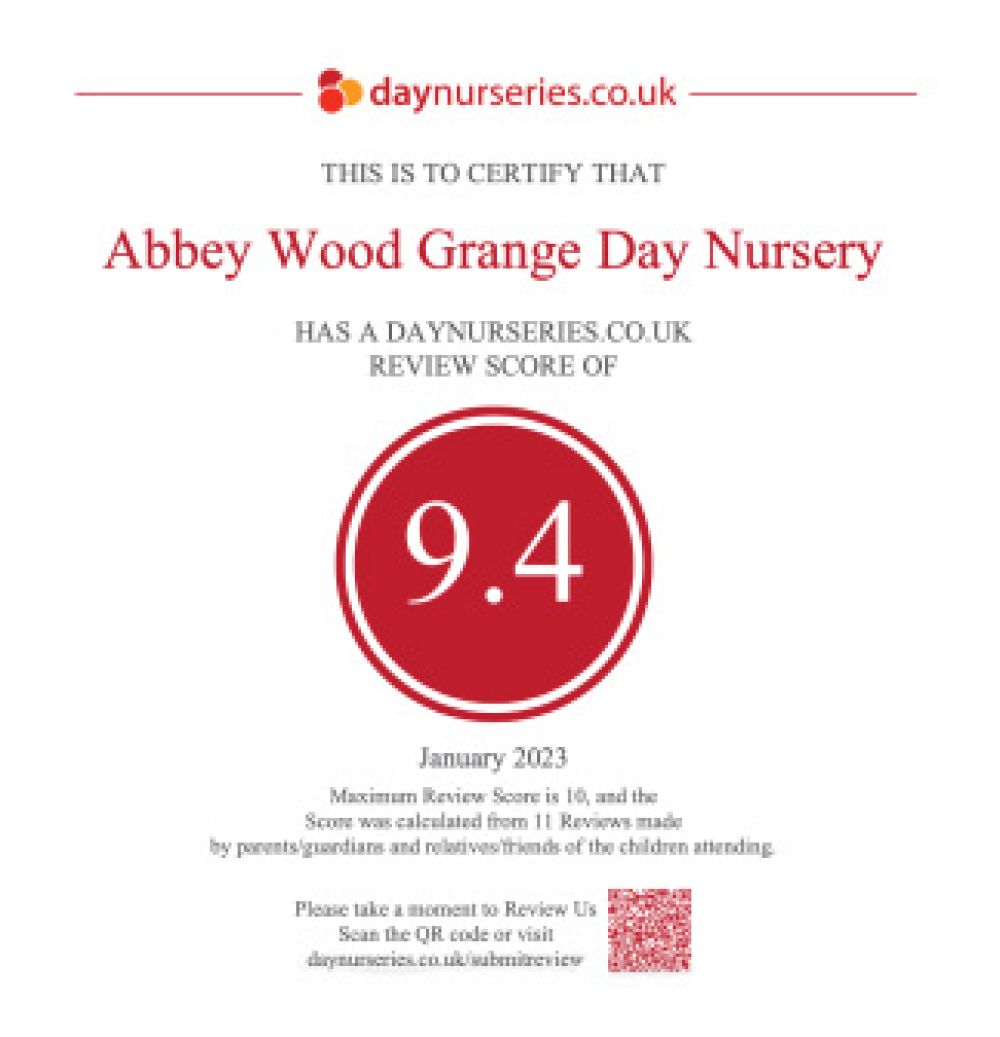

Abbey Wood Grange is a highly rated local nursery, we accept the government’s free childcare 15 / 30 hours allowance. If you are looking for a local nursery come and take a tour, see the facilities we have on offer and meet our dedicated staff team.